What is customer acquisition cost? Definition, formula, & example

Explore what customer acquisition cost is, why it matters, and how to lower it for better ROI.

Updated May 9, 2025

AI Summary

Understanding your customer acquisition cost (CAC) is crucial for sustainable business growth. Whether you're leading a startup or managing marketing for a Fortune 500 company, knowing exactly how much you're spending to get new customers helps you allocate resources effectively and maximize your return on investment.

We'll walk you through everything you need to know about CAC—from basic calculations to advanced optimization strategies—so you can make data-driven decisions that boost your bottom line.

Key takeaways

- To calculate CAC, divide the total marketing spend by the number of new customers gained.

- You can lower CAC through conversion optimization, referral programs, and better customer retention.

- Analyze CAC by channel to identify cost-effective strategies and optimize your marketing budget.

What is customer acquisition cost?

Customer acquisition cost is the total amount a business spends to acquire one new customer. This includes all marketing and sales expenses, such as advertising costs, marketing team salaries, creative development, software tools, and related overhead.

CAC shows whether your marketing efforts are paying off by revealing if you're spending less to acquire customers than they bring in. If your CAC is high or increasing, it's time to find what's not working and optimize your marketing strategy.

» Learn more about key metrics and KPIs for each stage of the SEO funnel.

Why is CAC important to marketers?

CAC is a critical marketing metric that impacts strategy development, budget allocation, and overall business health. Here's why CAC should be on every marketer's dashboard:

1. Measures marketing efficiency

CAC helps you determine how efficiently your marketing dollars are turning prospects into customers. It answers the fundamental question: "How much does it cost us to convince someone to buy from us?"

2. Informs budget allocation

When you know which channels bring in customers at the lowest cost, you can reallocate your marketing budget to maximize returns. This data-driven approach ensures you're investing in what really works.

READ MORE: Paid vs. organic customer acquisition

3. Enables accurate forecasting

With reliable CAC figures, you can predict how scaling your marketing efforts will impact your customer base and revenue, allowing for more precise planning.

» Ready to boost conversions? Learn how to forecast SEO ROI.

4. Guides pricing strategy

Understanding acquisition costs helps you set prices that not only cover these expenses but also ensure profitability over time.

5. Serves as an early warning system

Rising CAC might indicate market saturation, increased competition, or deteriorating campaign effectiveness—all issues that require prompt attention.

How to calculate CAC

Calculating CAC might seem straightforward, but getting an accurate figure requires careful consideration of all relevant costs. Here's the basic formula:

CAC = Total sales & marketing costs ÷ Number of new customers acquired

Costs to include in your CAC calculation

- Advertising spend: PPC, social media ads, display advertising

- Content marketing expenses: Blog posts, videos, infographics, podcasts

- Marketing team costs: Salaries, benefits, training

- Sales team investments: Salaries, commissions, bonuses

- Technology costs: CRM, analytics, automation software

- Creative expenses: Design, copywriting, video production

- Overhead allocation: Office space, utilities for marketing/sales

- External partnerships: Agency fees, consultant costs

- Customer onboarding: Setup costs, training materials

For accuracy, calculate CAC across different time periods (monthly, quarterly, annually) and break it down by individual marketing channels.

Let's look at an example of how this would work in practice.

Example of how to calculate CAC

Let's assume you're tracking your marketing expenses for Quarter 1, which includes several different channels. Here's the breakdown of expenses:

- Facebook ads: $5,000

- Google ads: $3,000

- Content marketing (freelancers, tools, etc.): $2,000

- Email marketing platform: $500

- Miscellaneous (landing pages, design, etc.): $1,500

This brings your total marketing spend for Q1 to $12,000. Now, let's calculate CAC.

In Q1, you acquired 400 new customers. To find your CAC, divide your total marketing spend by the number of new customers:

$12,000 ÷ 400 customers = $30 per customer

» Need help reducing CAC? Book a free consultation.

Metrics to track alongside CAC

CAC becomes even more powerful when analyzed with other key performance indicators. Here are the essential metrics to track alongside CAC:

1. Customer lifetime value (CLV)

This is arguably the most important metric to pair with CAC. CLV represents the total revenue a business can expect from a single customer throughout their relationship.

A healthy business typically maintains a CLV ratio of at least 3:1. This means each customer brings in three times more value than it costs to acquire them.

2. CAC payback period

This metric tells you how long it takes to recoup the cost of acquiring a customer. Shorter payback periods are generally better for cash flow and indicate more efficient acquisition strategies.

» Discover essential SEO KPIs that impact your acquisition strategy.

3. Return on ad spend (ROAS)

ROAS measures the effectiveness of your advertising campaigns by comparing the revenue generated to the cost of those ads. It helps you identify which specific ad initiatives deliver the best returns.

4. Average order value (AOV)

Understanding how much customers spend on average helps contextualize your CAC. Higher AOV can justify higher acquisition costs while maintaining profitability.

5. Conversion rate

This metric shows the percentage of prospects who become customers. Tracking various conversion metrics helps you identify opportunities to turn more visitors into buyers. Higher conversion rates naturally lead to lower acquisition costs, making this an essential lever for CAC optimization.

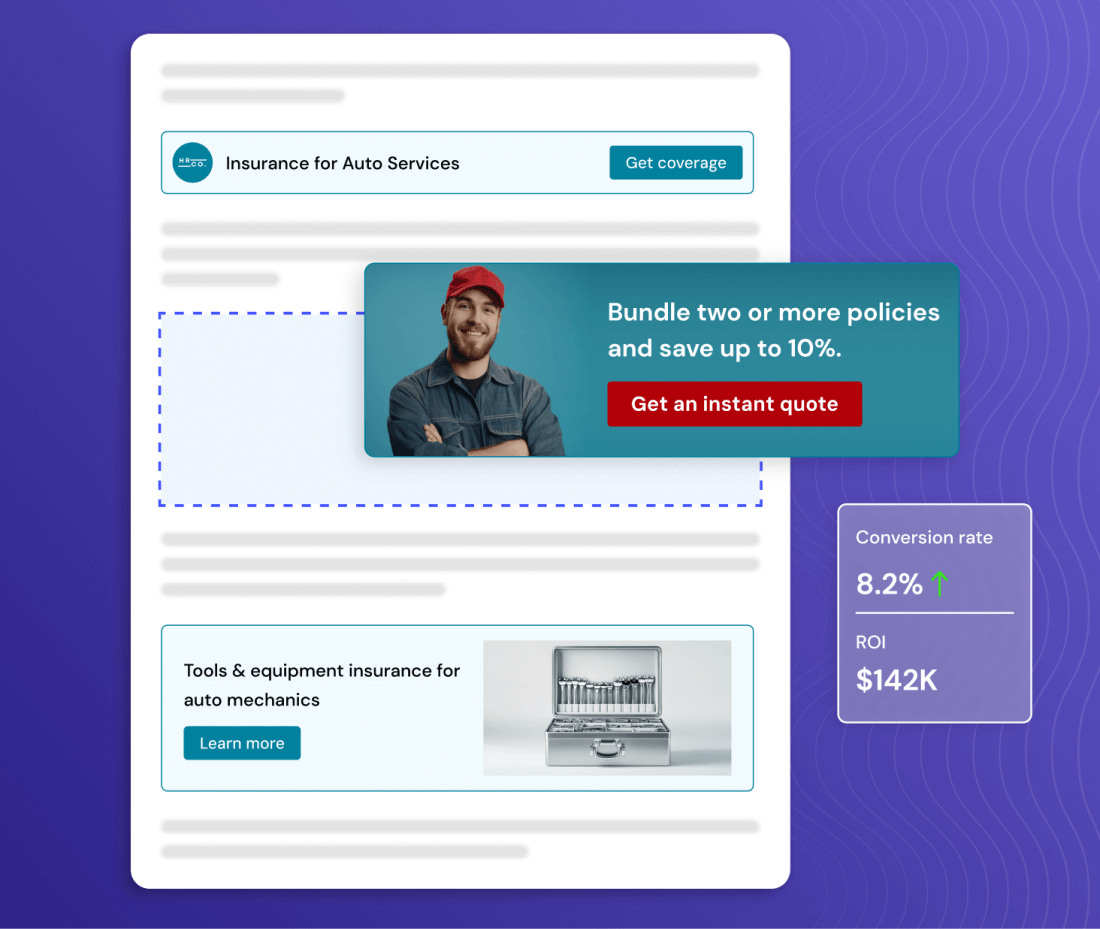

» Increase conversions and slash acquisition costs with Entail CRO.

5 proven ways to lower CAC

Reducing your customer acquisition cost can significantly improve your profit margins and overall business sustainability. Here are five effective strategies:

1. Optimize your content pages for conversion

Every visitor who leaves without converting represents wasted acquisition spend. By improving your conversion rate, you directly reduce your CAC When you convert more visitors, the cost per acquired customer drops proportionally.

For example, if you spend $1,000 on ads that bring 100 visitors and convert 1% (1 customer), your CAC is $1,000. Increase that conversion rate to just 2%, and your CAC immediately drops to $500.

Focus on creating high-converting content by:

- Adding contextually relevant CTAs throughout your content

- Aligning messaging with specific user journey stages

- A/B testing different content formats and landing pages

- Simplifying forms and checkout processes

» Explore SEO customer acquisition strategies to boost traffic and conversions.

Entail CRO helps businesses streamline this process by automatically generating intent-based calls to action and optimizing placement based on user behavior.

2. Implement a robust referral program

Referred customers typically have a lower acquisition cost and higher lifetime value. Develop a referral program that rewards existing customers for bringing in new business. This creates a cycle where satisfied customers become brand advocates and reduces your reliance on paid acquisition channels.

For an effective referral program:

- Offer meaningful incentives that benefit both the referrer and the new customer.

- Make the referral process simple with clear instructions and easy sharing options.

- Track referral sources to identify your most valuable advocates.

- Follow up with personalized thank-yous to strengthen customer relationships.

- Test different reward structures to find what drives the most high-quality referrals.

3. Focus on customer retention

While not directly reducing CAC, improving retention decreases the number of new customers you need to acquire to maintain growth. Implement these retention strategies:

- Develop a comprehensive onboarding process.

- Create loyalty programs that reward repeat business.

- Establish regular communication channels for feedback.

- Address issues promptly to prevent churn.

Pro tip: Increasing customer lifetime value makes higher acquisition costs more sustainable.

4. Optimize your marketing funnel

Many businesses lose potential customers due to inefficiencies in their marketing funnel. Analyze each stage to identify and eliminate bottlenecks:

- Enhance targeting to reach more qualified prospects.

- Streamline the path to conversion by removing unnecessary steps.

- Retarget users who have shown interest but haven't converted.

- Use marketing automation to nurture leads more efficiently.

» Try these bottom-of-funnel marketing strategies to convert more prospects.

5. Test and refine your value proposition

Sometimes, high acquisition costs stem from an unclear or unconvincing value proposition. Continuously test different messaging approaches to find what resonates best with your target audience.

Clear, benefit-focused communication can significantly improve conversion rates and lower your CAC.

For example, say a SaaS company changed their messaging from "feature-rich software solution" to "save time and reduce stress for your team." This benefit-focused approach can help to significantly increase conversion rates and potentially reduce CAC without requiring additional ad spend.

Cut down CAC to maximize ROI

By calculating CAC accurately, tracking it alongside complementary metrics, and implementing strategies to optimize it, you can create a more efficient, profitable growth engine for your business.

Remember that the goal isn't always to achieve the lowest possible CAC, but rather to find the optimal balance between acquisition cost and customer value. Sometimes, targeting higher-value customers might justify higher acquisition costs.

By making CAC analysis a core part of your marketing practice, you'll gain a competitive advantage that translates directly to improved profitability and sustainable growth.

» Learn how to reduce customer acquisition cost.